What Healthcare Payers Need to Know About Rising 1099 Penalties

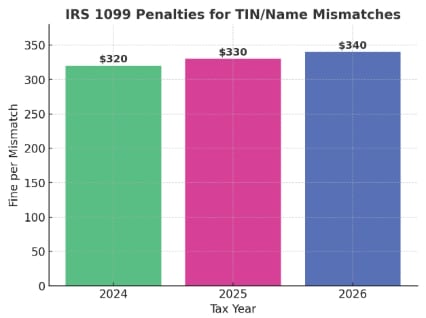

If you’re a healthcare payer, you know accurate 1099 reporting is critical. What you may not realize is that IRS penalties for mistakes are higher than ever — and still rising. For tax year 2025, the fine is $330 per mismatch TIN/Name, and in 2026 that amount will increase to $340 per mismatch.

When you consider how many providers you work with, even a handful of errors can add up to significant costs in IRS penalties.

What’s Changing

The IRS is stepping up enforcement and increasing penalties around 1099 reporting. Here’s what healthcare payers need to know:

-

Higher fines per form – Each incorrect or mismatched 1099 could cost you $330 in 2025, and $340 in 2026. If the IRS determines you showed “intentional disregard,” the penalties are even steeper.

-

Stricter accuracy checks – Electronically filed 1099s will soon be rejected if TIN/Name combinations don’t match IRS records.

-

Electronic filing rules – Filing 10 or more returns means you must file electronically, increasing the chances that errors will be caught.

-

Proof of due diligence – The IRS expects clear documentation showing that you collected or attempted to collect accurate W-9s. Without it, you may not qualify for relief from fines.

Why This Matters for Healthcare Payers

Healthcare payers manage large volumes of provider data. With so many records, it’s easy for a missing W-9 or outdated information to slip through the cracks. But with penalties set at $330 per mismatch for 2025, small mistakes can create a big financial hit — and that amount only increases in 2026. This can lead to huge costs in 1099 penalties.

How BASELoad Protects You

That’s where BASELoad comes in. Our 1099 Corrections solution is designed to help healthcare payers proactively clean up their data and avoid IRS penalties.

With BASELoad, you get:

-

Proactive error detection – We identify mismatched TIN/Names before you file.

-

Provider outreach – We handle the process of requesting and collecting updated W-9s.

-

Complete documentation – We track all corrections, giving you proof of due diligence if the IRS comes calling.

-

Proven results – Our clients have never been fined for TIN/Name mismatches.

Stay Ahead of Rising Penalties

With fines increasing to $340 per mismatch in 2026, healthcare payers can’t afford to leave compliance to chance. By partnering with BASELoad, you’ll reduce your risk, strengthen your reporting process, and gain peace of mind during filing season.

Contact BASELoad today to learn how our 1099 Corrections solution can help protect your organization from costly IRS penalties.

| Call Us | Email Us |

|---|---|

| 704-424-9889 | sales@baseload.com |